The United States Coast Guard says it is monitoring repairs aboard the liquid natural gas carrier Excel in Homer, Alaska, Friday, May 1.

The United States Coast Guard says it is monitoring repairs aboard the liquid natural gas carrier Excel in Homer, Alaska, Friday, May 1.

According to a news release from Coast Guard Sector Anchorage, USCG issued an order for the vessel to remain anchored in Kachemak Bay near Homer after the 908-foot, Belgium-flagged vessel experienced a loss of propulsion due to a failed engineering gasket while inbound to Cook Inlet Monday.

The Excel was bound for the existing LNG facility, the Kenai LNG Plant, located in Nikiski on the Kenai Peninsula, in Alaska. The state of Alaska is planning to expand the LNG facilities there, and that site is a potential rival for British Columbia’s LNG export plans.

The Coast Guard release says:

The Excel was examined by Coast Guard inspectors from Marine Safety Detachment Homer, Tuesday, who conducted a Port State Control annual exam and verified the engineering gasket was replaced.

While preparing to get underway Wednesday, the vessel experienced an automated engineering casualty and canceled its voyage until a Bureau Veritas (BV) classification surveyor could arrive and verify the engineering casualty was fully resolved. After arriving aboard the vessel, the class surveyor directed the vessel’s crew to test the automated engineering system and deduced that the casualty was a product of a faulty engine order telegraph; a device used on ships for the pilot on the bridge to order engineers in the engine room to power the vessel at a certain desired speed. Coast Guard Sector Anchorage issued another order for the vessel to remain in Kachemak Bay.

Friday, the vessel was allowed to continue sailing to her destination at the ConocoPhilips LNG plant in Nikiski after additional safety measures were implemented. As part of the safety measures, the tug Stellar Wind escorted the vessel from Kachemack Bay to Nikiski and a second tug, the Glacier Wind, stood by in Nikiski to assist with docking operations.

The Excel completed her voyage and safely moored at the ConocoPhilips pier in Nikiski at approximately noon Friday where it remains until permanent repairs are verified by the class surveyor and Coast Guard inspectors.

“Ensuring safe navigation in Western Alaska, particularly in Cook Inlet, is one of my highest priorities,” said Capt. Paul Mehler III. “Our crews worked closely with the Southwest Alaska Pilots Association, the class surveyor and towing vessel industry to coordinate a safe and secure transit of the Excel from Kachemak Bay to Nikiski. The weather was also in our favor with clear skies, light winds, and steady ebb tide during the transit in Cook Inlet.”

The LNG export plant at Nikiski was built in 1969 by Phillips Petroleum and Marathon Oil. Phillips later merged with Conoco and subsequently purchased Marathon’s 30 per cent share. The Nikiski plant sent LNG shipments to Japan from 1969 to 2010 under long-term contracts with Tokyo Gas and Tokyo Electric, when the contracts expired.

In 2011 ConocoPhillips announced that it would be ceasing LNG exports from Kenai and preserving the plant for potential future use.

With the LNG rush, market conditions changed and the the plant resumed making LNG in early 2012 and exported four cargoes to Asian customers over the course of that year.

In March 2013, the export licence expired and the LNG plant was put on standby. As interest in LNG grew, and at the urging of the state of Alaska, in December 2013 ConocoPhillips Alaska applied to resume LNG exports and the U.S. Department of Energy approved the resumption in April, 2014. ConocoPhillips says it received authorization to export a total of 40 BCF of liquefied natural gas over a two-year period from 2014 through 2016.

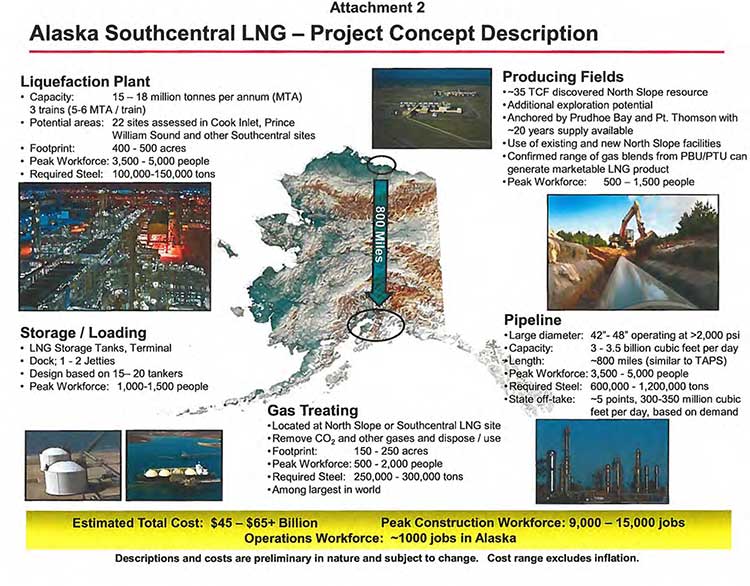

The Alaska LNG project is “a proposed $45 to $65 billion liquefied natural gas export project – it would be the largest single investment in Alaska history. The project has the potential to create between 9,000 and 15,000 jobs during the design and construction phases; plus approximately 1,000 jobs for continued operations. In addition to generating billions of dollars in revenue for Alaska, the project will provide access to natural gas for Alaskans.” The project’s participants are the Alaska Gasline Development Corporation (AGDC) and affiliates of TransCanada, BP, ConocoPhillips, and ExxonMobil.

Related

First of six LNG shipments delivered at Nikiski

Alaska Journal of Commerce, May 2014

Alaska LNG fact sheet. (PDF)

Kenai LNG fact sheet (PDF)