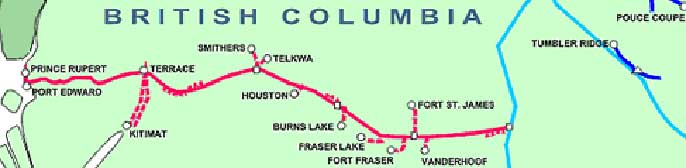

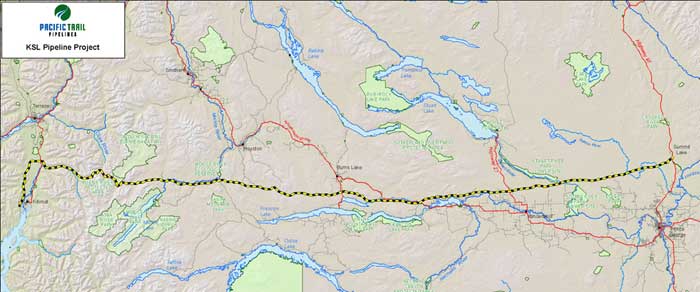

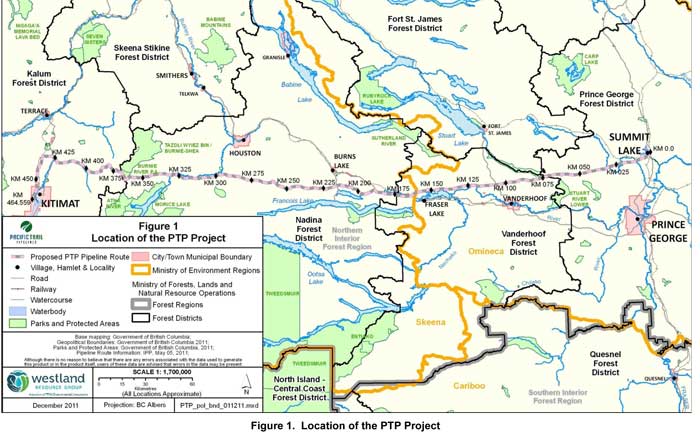

Another pipeline debate is about to open in the northwest. This time for changes to the Pacific Trails (natural gas) Pipeline, that will run from Summit Lake, just outside Prince George, to Kitimat.

Public information meetings will be held in Terrace, Houston, Burns Lake and Vanderhoof in the next couple of weeks.

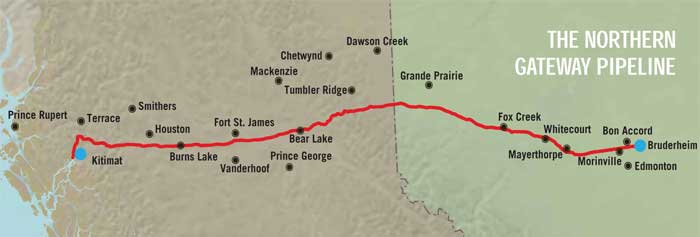

The PTP runs entirely within British Columbia, and so comes under the jurisdiction of the Environmental Assessment Office of British Columbia. The application to build the PTP was filed in 2005 and approved in 2008 which means the process for the amendments will go much faster than the current Northern Gateway Joint Review hearings for the Enbridge twin bitumen/condenseate pipeline which are expected to last at least another eighteen months.

Pacific Trails is asking to

- Change the location of the compressor station;

- Establish two new temporary stockpile sites;

- Make pipeline route modifications

The period for commenting on the Pacific Trails Pipeline amendments opens on February 27 and closes March 28. The public meeting on the changes to the compressor station were held in Summit Lake last September.

The documents filed with the BCEAO say that Pacific Trails Pipelines is in ongoing negotiations with First Nations where the PTP will cross their traditional territory.

The natural gas project has general support in northwestern BC, and the relations between First Nations and PTP, and Apache, the main backer of the Kitimat LNG project are much better than those with Enbridge. (The PTP would supply the liquified natural gas terminals in Kitimat)

Significantly, the documents show that the PTP is trying to enter separate negotiations with the Wet’suwet’en houses that are now objecting to the pipeline route through their traditional territory.

The filing says:

In addition, PTP is now consulting, or making all reasonable efforts to consult, with one of the 13 Wet’suwet’en Houses as a discrete entity. PTP was informed in February 2011 that Chief Knedebeas’s House, the Dark House, was no longer part of the Office of the Wet’suwet’en although the latter still maintains responsibility for the welfare of all Wet’suwet’en lands and resources. Consultation that took place prior to this year with the Office of the Wet’suwet’en included consultation with the Dark House. PTP has been diligent in seeking to consult with the Dark House since April 2011. The spokesperson for Chief Knedebeas of the Dark House, Freda Huson, states that she also represents a group called Unist’ot’en.

But it’s Enbridge that is the sticking point, and could bring controversy to this amendment request. The Wet’suwet’en houses that blockaded a PTP survey crew last fall said they were worried that the Northern Gateway pipeline follows roughly the same route as the PTP. The PTP application was filed and approved long before the controversy over the Enbridge Northern Gateway began to heat up.

One reason is that original approval was for a pipeline to import natural gas before the shale gas boom changed the energy industry. As PTP says in the application to change the compressor station.

When the original purpose of the PTP Project was to transport natural gas from an LNG import facility at Kitimat to the Spectra Energy Transmission pipeline facilities at Summit Lake, the design called for the installation of a mid-point compressor station to enable the required throughput of natural gas. This compressor station was sited at the hydraulic mid-point of the pipeline. The location of the compressor station in 2007 was south of Burns Lake and just east of Highway 35.

Now that the PTP Project is designed to move natural gas from Summit Lake to Kitimat, or east to west, a compressor station is required at Summit Lake rather than at the hydraulic mid-point of the pipeline. The new Summit Lake compressor station is required in order to increase the pressure of the natural gas from where it is sourced at the Spectra Energy Transmission pipeline facilities.

The EAO will hold open house meetings on the pipeline route changes from 4 pm to 8 pm at each location at

Monday, February 27, 2012

Nechako Senior Friendship Centre, 219

Victoria Street East

Vanderhoof, BC

Tuesday, February 28, 2012

Island Gospel Gymnasium

810 Highway #35

Burns Lake, BC

Wednesday, February 29, 2012

Houston Senior Centre

3250 – 14th Street W

Houston, BC

Thursday, March 1, 2012

Best Western Plus Terrace Inn

4553 Greig Avenue

Terrace, BC

The EAO says: Displays containing information on the proposed amendments will be available for public viewing. The EAO will be available to answer questions on the amendment process. The Proponent will be available to answer questions on the Project and proposed amendments.

The documents show there are route changes to the pipeline route along the Kitimat River, but those are considered “minor route adjustments” so no meetings are planned for Kitimat.

Documents

Complete filing documents from PTP are available on the BCEAO site here.