Enbridge Northern Gateway wants a much larger tank farm at its proposed Kitimat terminal, the company says in documents filed with the Joint Review Panel on December 28, 2012.

On that date, Enbridge filed its fifth revision of the Northern Gateway pipeline route and plans with the JRP. While for Enbridge engineers the filing may be a routine update, as surveys and planning continue, Smithers based enviromentalist Josette Weir has filed an objection with the JRP challenging the revised plans because, she says, the JRP has closed off any opportunity for intenvenors to make their own updates, calling into question once again the fairness of the JRP process.

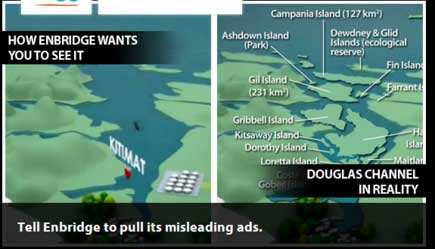

From the documents filed with the JRP, it appears that Enbridge wants not only to expand the tank farm and adjacent areas but also to have a potentially much larger area on the shores of Douglas Channel for even more expansion in the future.

At the Kitimat terminal, Enbridge says there will now be 16 oil tanks, up from the original 11. The company also says: “The terminal site will also have some limited additional civil site development to allow for potential future site utilization.” While Enbridge proposes to keep the number of condensate tanks at three, their capacity would be increased.

In addition, Enbridge wants an enlarged “remote impoundment reservoir” to comply with the BC Fire Code, so that it would be:

• 100% of the volume of the largest tank in the tank farm, plus

• 10% of the aggregate volume of the 18 remaining tanks, plus

• an allowance for potential future tanks, plus

• 100% of the runoff from the catchment area for a 1 in 100 year, 24 hour storm event, plus

• the amount of fire water generated from potential firefighting activities at the tank farm.

Enbridge goes on to note:

An update to 16 oil tanks at the Kitimat Terminal is not expected to alter overall visibility of the marine terminal and therefore impact visual or aesthetic resources.

In her news release, Josette Wier, who describes herself as “an independent not funded intervenor in the hearing process,” says she filed a notice of motion on January 17, 2013, noting “there are numerous embedded proposed changes which have nothing to do with the route revision,” including the fact that “the tank farm in Kitimat is considerably increased from 11 to 16 tanks for the oil tanks with an almost doubled working capacity, while the condensate tanks capacity is increased by 29 per cent.”

“What does this have to do with a route revision?” she asks in the news release.

In the news release, Wier says: “that this is an abuse of process when engineering and design question period ended in Prince George last November. Not withstanding the underhanded way of presenting new evidence, re-questioning on those issues doubles the amount of work and expenses for intervenors.

“Abuse of process”

She asked the Joint Review Panel to order Northern Gateway to re-submit their proposed changes indicating clearly the ones unrelated to the route changes and describing them along with their rationale.

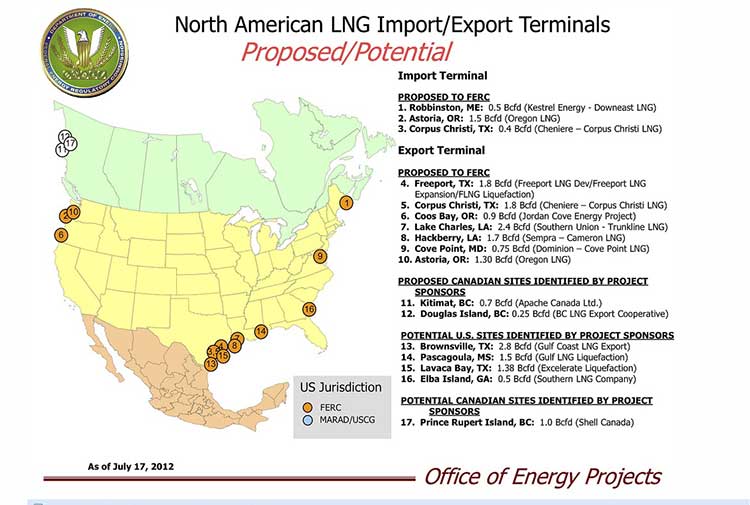

Wier goes on to say: “It is everyone’s guess why there is a doubling of the tank farm capacity, but certainly points out to the larger pipeline shipping volumes the company had indicated would be a possible Phase II of the project.” She says: “It looks like Northern Gateway is quietly moving into the 850,000 barrels a day proposal, twice the volume the application has been cross-examined about. It is clearly an abuse of process.”

In her actual notice of motion, Wier goes further by taking aim at the JRP itself by saying that “the Applicant [Enbridge] can make changes to the Application whenever they want. We have already seen in their July submissions inclusion of new evidence which conveniently escaped information requests. The added work and cost imposed on intervenors and the Panel seem irrelevant to the Applicant.” She complains that her requests for more information in an earlier notice of motion “was dismissed by the Panel on the grounds that my request ‘would require an unreasonable amount of effort (both by Northern Gateway and other parties reviewing the material’ …. If this argument applied to my Notice of Motion, I suggest it should apply to embedded changes buried in the Applicant’s filings of December 28, 2012.”

Rerouting at Burns Lake

A number of the other changes appear to show continued strained relations between Enbridge and First Nations, for example it says:

There is a possibility of relocating the pipeline route… further north of the Burns

Lake area to avoid proposed Indian Reserve lands that would overlap the pipeline route,.. This revision will be evaluated when further information on the proposed Indian Reserve lands is available and when further consultation with the relevant Aboriginal groups has taken place.

On the other hand the revisions also show that the pipeline will be now routed through an existing right of way through the Alexander First Nation, near Morinville, Alberta, as part of an agreement with the Alexander First Nation.

Another route change is near the Morice River, where Enbridge says

The Morice River Area alternate will generally have less effect on wildlife riparian habitat since it is located away from the Morice River and floodplain. This revision is also farther from the proposed Wildlife Habitat Area for the Telkwa caribou herd and no longer intersects any primary and secondary goat ungulate winter range polygons. However, this revision no longer parallels the Morice West Forestry Service Road (FSR) and Crystal Creek FSR and offers fewer opportunities to use existing rights-of-way. This may increase linkages between cutblock road networks and increase human access locally but does not preclude Northen Gateway from applying other methods to minimize linear feature density in this region.

Wier also complains that the Enbridge did not properly file its latest documents, asking the panel to rule that it order Northern Gateway to re-submit their last revisions submitted in December

using proper JRP evidence numbering system and “Adobe pages numbers.” The huge number of documents in the JRP system is confusing and improper filing makes it harder for intervenors and others to sort their way through new information.