The prospect of Kitimat becoming a major port for export of Liquified Natural Gas was bound eventually to spark interest in the media covering the energy sector.

Alcan came to northern British Columbia in the early 1950s with plans to build the world’s biggest aluminum smelter….

Even by today’s standards of engineering, the $500-million “Kitimat Project” was ambitious…. They bored into a mountain to create the Kemano hydro plant. They blasted enough rock to dam and reverse the Nechako River. They strung high-wire transmission towers across a rugged valley. And they built Kitimat – complete with schools, pre-fabricated houses floated in on barges, roads and even a toastmasters club – from scratch.

It is to this history that Mayor Joanne Monaghan refers when she dismisses fears about development in the region ruining a natural wilderness. “Kitimat is geared to be an industrial town,” she says over lunch at the local Chalet Restaurant. “That’s what it was built as.” Distinct neighborhoods and services were laid out for a population many thought would crest 50,000, with heavy industry built at a remove from the commercial and residential areas of town.

The vision never quite materialized… Monaghan… insists job prospects in the town are poised for recovery. The unemployment rate was 9.5 per cent in 2006. “I think it can only get better from here,” the mayor says. “I really feel like we’re a sleeping giant, and the giant is waking up.”

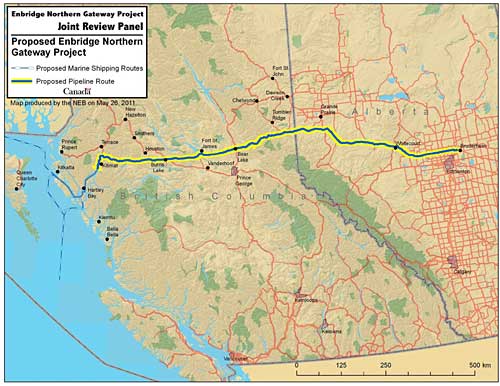

It is also true that the town remains partially stuck, very much groping in what is perhaps the darkest hour before the mayor’s dawn. Local divisions aren’t limited to the physical split between the town’s industrial park and its residential streets. While the Apache-sponsored gas terminal has progressed to the point where site preparation is underway, Enbridge’s Northern Gateway faces tremendous opposition – from the Haisla, but also from pockets of local residents. The multibillion-dollar pipeline has underscored deep-seated tensions in the region to such an extent that the local council refuses to talk about it. Some, including Monaghan, favor a referendum on the project. “It’s a contentious issue,” she says.

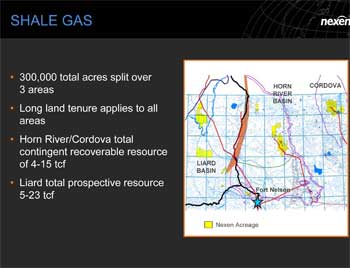

The Financial Post’s energy reporter Claudia Cattaneo focuses more on the issues on her beat in LNG Trying to Dock Catteneo notes that the March earthquake in Japan which crippled the country’s nuclear energy raised interest in exports of liquified natural gas from Alberta through the port of Kitimat.