The future of tankers sailing along the British Columbia coast, and the export of crude through BC could change drastically by the end of 2014.

- By some time in 2014, the planned expansion of the Panama Canal will be complete, allowing more large ships, including tankers, to pass through the Canal and ply up and down the west coast.

- It is also possible that British Columbia coastal ports could not only be used for export of bitumen from the Alberta oil sands and liquified natural gas from northeast BC, but also for oil shale crude found in the Bakken Shale formation in North Dakota and Montana, possibly later shale oil from Saskatchewan and Manitoba.

Those startling conclusions are found in the full draft supplementary Environmental Impact Statement (EIS) on the Keystone XL pipeline project issued last week by the United States States Department. (Most media reports concentrated on the EIS executive summary, the details on British Columbia are contained in the actual report).

The Keystone EIS surprisingly contains a number of scenarios in British Columbia, even though BC is thousands of kilometres from the proposed TransCanada pipeline from the bitumen sands to the refineries on the US Gulf Coast.

The State Department report had to give President Barack Obama all possible options and that it why the EIS report included what it calls “no action alternatives” –what would happen to the bitumen and oil if Obama rejects the Keystone pipeline. Assuming that the oil, whether bitumen or Bakken oil shale has to get to the Gulf refineries by other means, the EIS takes a close look at one case, via CN rail to Prince Rupert, from Prince Rupert by tanker down to the expanded Panama Canal, then through the Panama Canal to the oil ports of Texas and Louisiana.

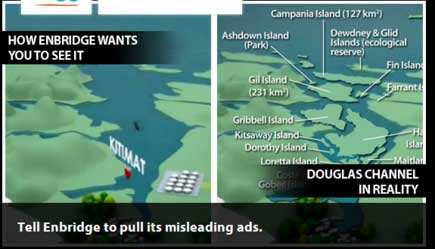

Another possibility, although less detailed in the EIS, also considers scenarios where bitumen from the Alberta oilsands or shale crude from the Bakken formation was shipped to Vancouver via the Kinder Morgan pipeline system, to Kitimat via the proposed Northern Gateway pipeline.

The State Department rejected the Kinder Morgan and Northern Gateway options for detailed analysis because of the controversy over both projects.

The Keystone EIS was released by the State Department on Friday, March 1, 2013, and is seen as generally favouring TransCanada’s Keystone XL pipeline project. Despite the EIS report conclusions that the Keystone project would have little adverse impact, the final decision by President Obama will be largely political.

The Prince Rupert scenario

The State Department “Supplementary Enviromental Impact Statement” on the Prince Rupert and several other scenarios were undertaken

In developing alternative transport scenarios, efforts were made to focus on scenarios that would be practical (e.g., economically competitive), take advantage of existing infrastructure to the extent possible, used proven technologies, and are similar to transport options currently being utilized.

The State Department studied a scenario that would

Use of approximately 1,100 miles (1,770 kilometres) of existing rail lines from the proposed Lloydminster rail terminal complex to a new approximately 3,500-acre (1,400 hectare) rail terminal complex where the oil would be offloaded from the rail cars, with a short pipeline connection to the port at Prince Rupert.

That possible replacement for Keystone scenario calls for adding approximately 13 trains with 100 tanker car per day on the CN and Canadian Pacific rail lines between Lloydminster and Prince Rupert. (There is also a separate scenario for a rail route from Alberta to the US Gulf Coast. That scenario is not examined in this report)

That, of course, would be in addition to the already heavy rail traffic to Prince Rupert with grain and coal trains outbound and container trains inbound, as well as the VIA Skeena passenger train.

(David Black who is planning a possible refinery at Onion Flats, north of Kitimat, has said that if the Northern Gateway pipeline is stopped, the Kitimat refinery could be serviced by six trains per day, 120 cars in each direction.)

The railway to Prince Rupert is evaluated using the same criterion under US law that was used to evaluate the Keystone project, including affects on surface water, wetlands, the coast, wildlife, threatened and endangered species, fisheries, landuse, construction, green house gases and even sea level rise.

The EIS for Prince Rupert, however, dodges one of the key questions that is plaguing the Northern Gateway Joint Review panel. While it points out the possible dangers of an oil spill, the report does not go into any great detail,

The overall EIS view of the impact of a Prince Rupert project would likely bring protests from those who already oppose the Northern Gateway pipeline project.

the transport of the crude oil via tankers from Prince Rupert to the Gulf Coast area

refineries would not have any effects on geology, soils, groundwater, wetlands, vegetation, land use, socioeconomics, noise, or cultural resources, other than in the event of a spill.

The State Department scenario says there would be

one to two additional Suezmax tanker vessels per day (430 tankers per year) would travel between Prince Rupert and the Gulf Coast area refinery ports via the Panama Canal.

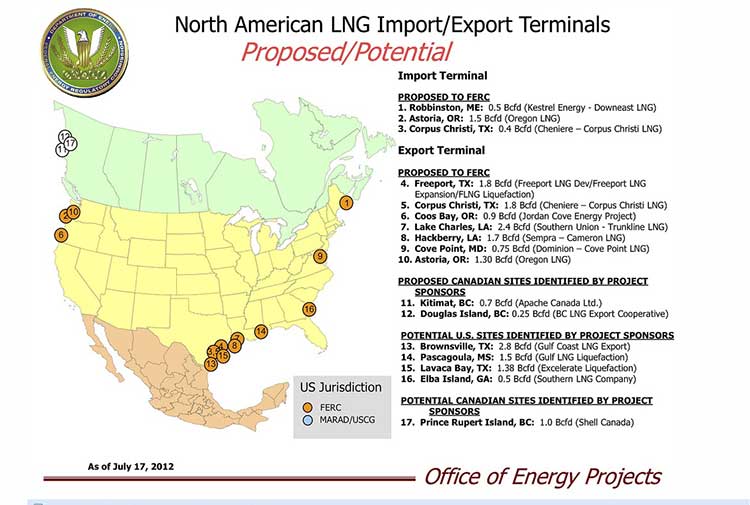

That, of course, could be in addition to any tankers from the Northern Gateway project, if it is approved, as well as tankers from the liquified natural gas projects at both Kitimat and Prince Rupert.

Expanded Panama Canal

The concept of the Suezmax tankers is critical to the west coast, even if none of the scenarios eventually happen.

The State Department report notes that the Panama Canal is now being expanded, and that beginning sometime in 2014, larger ships, including tankers, can go through the canal. The current size is Panamax (maximum size for the current Panama Canal) to Suezmax (the maximum size for the Suez Canal).

(The Panama Canal expansion program began in 2006 and is scheduled for completion in 2014.

Latest Panama Canal progress report (pdf)

The Vancouver Kinder Morgan Scenario

According to the State Department that means even if the even bigger Very Large Crude Carriers are not calling at west coast ports to take petroleum products to Asia, the Suezmax tankers might likely be calling in Vancouver at the terminal for the existing (and possibly expanded) Kinder Morgan pipeline.

Both Kinder Morgan and Port Metro Vancouver have said that the ships that call at the Kinder Morgan Westridge Terminal are Aframax tankers, and even they are not loaded to capacity, because of the relatively short draft in the Burnaby area of Vancouver harbour. Both Kinder Morgan and Port Metro Vancouver say that there are no current plans for larger tankers to call at Westridge.

So one question would be is the State Department report pure speculation or is there, perhaps, somewhere in the energy industry, a hope that one of Vancouver’s deeper draft ports could be the terminal for a pipeline?

Rails to Rupert

The Keystone EIS for the first time outlines the railway to Rupert senario, which has long been touted by some supporters as an alternative to the Northern Gateway project, but without the detailed analysis provided for Northern Gateway by both Enbridge and those opposed to the project. Although based largely on published documents and in some ways somewhat superficial (the State Department can’t find any cultural resources in Prince Rupert), the EIS largely parallels the concerns that are being debated by in Prince Rupert this month by the Northern Gateway Joint Review Panel.

Northwest Coast Energy News Special report links

What the Keystone Report says about Kitimat and Northern Gateway

What the Keystone Report says about the Kinder Morgan pipeline to Vancouver.

What the Keystone Report says about CN rail carrying crude and bitumen to Prince Rupert.

The State Department Environmental Impact Study of the railway to Prince Rupert scenario.

State Department Index to Supplemental Environmental Impact Study on the Keystone XL pipeline