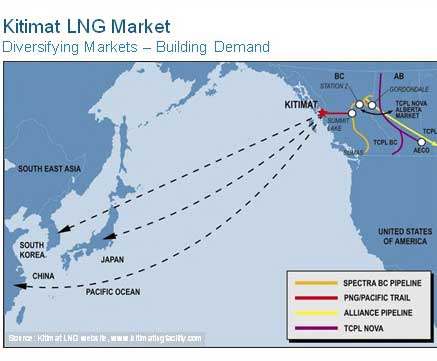

It looks like the Chinese curse (and journalist’s blessing) “May you live in interesting times,” has come to Kitimat, especially when it comes to selling LNG to Asia.

In the past months the world liquified natural gas market has become more volatile with increased competition across the globe and, in some cases, political factors adding to the molecule mix.

In the past few days, Alberta Oil magazine has published a series of articles on the Kitimat LNG projects, describing the projects as a high stakes poker game.

The point is that the potential Asian buyers for BC (and US) liquified natural gas want a secure supply and they’re not sure what is going on on this side of the Pacific.

That’s apparently why the first project, KM LNG, has put off the final go ahead project from the first quarter of 2012, as originally expected, to the now likely the fourth quarter of 2012.

That has left a lot of uncertainty in town, despite assurances from two of the KM LNG partners, Apache Corporation and EOG Resources that they are optimistic that there will be a deal with Asian gas buyers, even if it means Asian equity in the KM LNG project.

That uncertainty in Kitimat has led to widespread rumours, none substantiated, that the three proposed projects, by KM LNG, by the Houston-Haisla BC LNG partnership and Shell, may be consolidated in one way or another.

At Kitimat council on Monday, April 2, Mayor Joanne Monaghan said “There has been a rumour around recently that Apache is stopping their working for a year and I talked to the CEO, Tim Wall, yesterday and he assured me that that was not true.”

Work is continuing on the KM LNG site at Bish Cove.

This morning, April 5, 2012, Alberta Oil reported that EOG Resources boss still bullish on Kitimat LNG, quoting a company called Bernstein Research that met with EOG’s top executive, CEO Mark Papa, who told Bernstein that EOG considers its 30 per cent holding in KM LNG as a “core holding.”

In a Thursday research note, Bernstein’s Bob Brackett says EOG is willing to sell some of its stake in the Kitimat project to a buyer (likely of the Asian persuasion) looking for equity in the upstream portion of project. “EOG expects to dilute a portion of its stake for that purpose,” Brackett writes.

A day earlier, Alberta Oil reported in Global LNG players jockey for space on a crowded field noting that Australia’s LNG megaprojects are facing competition from North America and cost inflation as the number of projects increase. At the same, US LNG projects are trapped in the current mire of US politics, with many politicians wary of the energy-starved US exporting natural gas.

In Apache Canada makes global push amid fierce competition, the article that uses the poker analogy, the magazine quotes Asish Mohanty, senior research analyst, global LNG, with Wood Mackenzie

Kitimat is due to start pumping out five million tonnes of LNG by 2015, widely viewed as a market “sweet spot” because it beats a number of major Australian projects – among them Shell’s massive Prelude endeavor – into production. “It’s a bit of a race,” Mohanty at Wood Mackenzie says. “The general impression in the industry is that before these Australasian projects start up it’s going to be a sellers’ market.”

Mohanty also looks at the problem of cost inflation and limited resources, a problem Kitimat already faces with not only the three proposed LNG projects but RTA’s Kitimat Modernization Project.

Companies that specialize in engineering, procurement and construction of liquefaction facilities number fewer than 10 internationally, Mohanty says. He expects many of them will be kept busy by construction of several LNG projects underway in northwest Australia, including ongoing work at the massive Gorgon plant at Barrow Island. The Chevron-led venture is due to begin pumping out 15 million tonnes of LNG annually by 2014-15. “All of these are massive projects,” the analyst says. “What that means is order books are pretty full. There is a scarcity of resources in places like Australia right now.”

The shortfall could potentially squeeze Canadian LNG forays. “The fact that most of the B.C. facilities are going to be ‘green-field’ will not make it easy for them to meet a timeline compared to a lot of others.”

Related CBC News Mackenzie Valley pipeline funding reduced

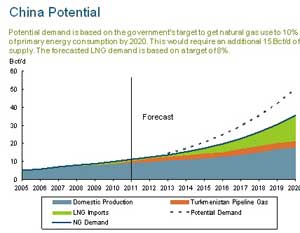

China is probably the largest long

China is probably the largest long Dave Thorn, Encana vice president of

Dave Thorn, Encana vice president of The Kitimat project is currently

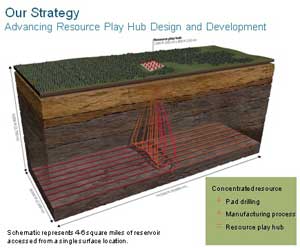

The Kitimat project is currently Encana says it has developed a “hub”

Encana says it has developed a “hub”