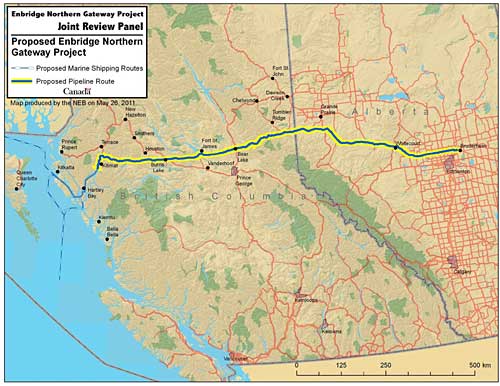

The ghost of the Enbridge Northern Gateway proposal is always behind the scenes in the stuffy meeting room at the Riverlodge Community Centre as the National Energy Board considers KM LNG’s application for a liquified natural gas export licence through the port of Kitimat.

Officially, in the view of the board and the lawyers in the room, the Enbridge proposal is neither, legally nor practically, part of the proceedings.

The two hearings are quite different. The KM LNG is, in the view of the National Energy Board, nothing more an application for an export licence. The Joint Review is considering the Northern Gateway “facility.” That is much wider.

Today, one of the key issues about the Northern Gateway proposal came to the forefront: the question of responsibility for tankers, whether those tankers carry bitumen or cryogenic cooled natural gas.

Wednesday was a hot summer day, the meeting room at Riverlodge even hotter, with no air conditioning, just a few lazy ceiling fans. In the opening moments of the hearings, one of the lawyers joked about not wearing his tie, reminiscent the opening courtroom scene in the play and movie, Inherit the Wind, based on the Scopes Monkey Trial, where Clarence Darrow (played by Spencer Tracy as Henry Drummond) confronted William Jennings Bryan (played by Frederic March as Matthew Brady)

The subject of Wednesday’s proceedings was, on the surface, dull and purely economic, charts and graphs, “Export Assessment,” guaranteed to make most of the people in the warm room to nod off.

The main witness on the panel of export experts was Roland Priddle, an Ottawa-based “consultant in energy economics.”

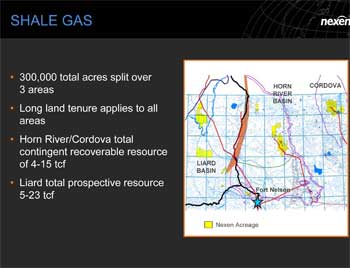

The initial questions were routine, about imports and exports of natural gas in Canada. The experts said the use of shale natural gas is expected to increase from two per cent of the Canadian market to 34 per cent over the next 25 years. The panel estimated that there are more than 40 shale gas “plays” are under development or planned in Canada.

For the public, the NEB hearings are a bit opaque. Unlike a public inquiry or a court hearing, the direct testimony has already occurred, in the documents the companies, consultants and experts have filed. The lawyers then ask questions on those filings.

Robert Janes, of the

Janes Freedman Kyle law firm, specializing in aboriginal law cases, based in Vancouver and Victoria, represents the

Gitxaala, a small coastal First Nation, based in Kitkatla on the northern BC coast.

Janes began his cross-examination of Priddle, asking about the supply chain and later at what geographic point the natural gas was officially “exported.”

Priddle hesitated for a moment, said he was unsure about natural gas, then replied that years before, when he had worked for the oil industry that the “title” to the oil changed at the “joint flange” where the pipe connected with the manifold on the oil tanker.

Priddle’s apparently innocuous statement made the few Kitimat residents left at the hearing sit up and pay attention.

The previous September, if there was a moment when you could actually see in a room at Riverlodge that a community’s attitude toward Enbridge changed, it was on Sept. 22, 2010, when the Enbridge outreach group told the audience that the company had no legal responsibility for the bitumen it would pipe from Alberta once it was loaded on the tankers.

Under further questioning from Janes, Priddle said that the fact that title to the oil changed at the “flange connection” had been traditional in the oil industry for decades.

Janes then furthered his cross-examination by asking Priddle and also other members of the export panel, about where “export” actually occurred, at the “flange connection” or at the 12-mile international ocean limit.

That question set the stage for an almost day long clash between Janes and Gordon Nettleton, of

Osler, Hoskin & Harcourt‘s Calgary office, representing KM LNG. Nettleton bears a superficial resemblance to Frederic March’s Matthew Brady and while the next hours were not really the epic struggle between Darrow and Bryan, it was two good lawyers sparring over the somewhat restrictive rules of evidence that govern National Energy Board hearings, while the real question was the future of the western coast of Canada.

Nettleton tried to keep Janes’ questions narrow, just to the material in Priddle’s written submission to the NEB. Nettleton told NEB panel chair, Lynn Mercier, that Janes should ask about the “capital intensity of the LNG chain” and not “how cryogenic shipping relates to shipping and export points.”

Janes responded that “If you look at the report, Priddle talks about the chain in general aspects, all parts of the chain including government approvals.” Janes then told the NEB panel that “cross-examination can bring out knowledge of the witness as whole.” Perhaps that is true in court or at a public inquiry, but not necessarily before the National Energy Board.

Nettleton replied that Janes should have asked those questions either of Monday’s policy panel, a rather dull affair, where there few questions from any of the lawyers at the hearing or at later panel on “terminal approvals” scheduled for Thursday or Friday. Nettleton told Mercier he didn’t want Janes to have a “blank cheque” to cross-examine based on one sentence in Priddle’s report.

The problem is that the NEB practice of using narrowly focused “expert” panels, while perhaps routine in the towers of the Alberta oil patch, doesn’t always coincide with the controversies over tankers on the BC coast, especially in the case of KM LNG where the NEB hearing for the export licence is what policy calls a “market-based procedure,” focusing solely on the facts and figures of the economy of natural gas.

Somewhat stymied by the narrowness of the hearings, Janes proceeded to ask questions about how the natural gas market had changed over the past few years. Again Nettleton objected to some of Janes’ questions that were beyond the scope of Priddle’s original written report.

Janes was trying to establish that the northeastern British Columbia shale gas deposits would eventually be developed whether or not the Kitimat LNG terminal was given NEB approval.

Priddle replied by giving Janes a lecture in economics, saying that while the advantages or disadvantages for First Nations were beyond his expertise, as an economist he felt that if Janes that had an interest in the welfare of his First Nations clients and their social development, it also should extend to other First Nations groups in both British Columbia and Alberta. “As an economist,” Priddle said, “I tend to follow the ‘present value princple,’ he said, explaining that it is best if a person gets a job now, “the person who is not employed in 2012 and 2013 but will get some employment in the future… that native looses the five years” and “so there is much less economic value” for that individual person.

“What is the benefit taking the project now, taking the development now?” Janes asked. “If we do this rigorously, what are the costs imposted on the aboriginal person? I suggest that proper economic analysis requires both sides of the equation.”

Priddle avoided that question, saying to Janes. “you are moving away from my evidence.”

With that, Janes had finished his questioning and the hearings broke for lunch.

Most of the afternoon was concerned with questions over the future of an integrated North American natural gas market and how, in the future, Canadian natural gas might be exported not just to the United States but through the US to Asia, while at the same time American natural gas could be imported into Canada to service some markets.

As the day closed, in the heat of the afternoon, and as many were anxiously looking at their watches as the clock neared the time for the puck drop for the fourth game of the Stanley Cup finals between the Vancouver Canucks and the Boston Bruins in Boston, Mercier called on Nettleton to ask any redirect questions to Priddle and the rest of the panel.

Nettleton seized on the scenario that it was possible that Alberta natural gas could be exported to Asia through a port on the US west coast.

“If KM was not allowed to proceed, and the potential outlet was in the United States, how do see that as advantageous to [BC] First Nations?” Nettleton asked Priddle.”Objection!” Janes was on his feet to protest: during the cross-examination, Priddle had indicated that the advantages and disadvantages had moved beyond the evidence in his written submissions.

“What’s good for the goose, is good for the gander,” Janes told Nettleton. “This is completely out of bounds,” because Janes had not been able to examine Priddle on the question, it was not proper rexamination, it was outside of the evidence.

“I have asked if Mr Priddle to comment,I have not asked for an opinion whether there would be costs or benefits for First Nations that would be affected by Kitimat LNG,” Nettleton said.

“That is the question I am objecting to,” Janes replied.

After some more arguments, Mercier concluded that a comment and an opinion were pretty much the same thing and the hearing adjourned. The participants fled to watch the Bruins trounce the Canucks 4-0 and the stage was sit for more clashes on Thursday as the more substantial expert panels face the lawyers.