Energy

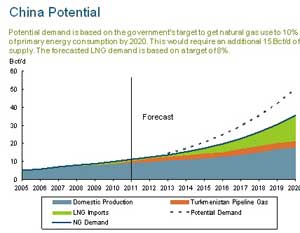

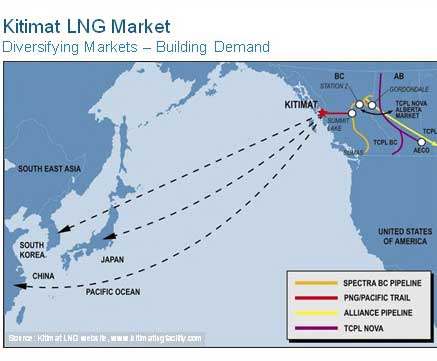

China is probably the largest long

China is probably the largest long

term customer for liquified natural gas that will be shipped through

the port of Kitimat, executives from Encana, one of the three

partners in the KM LNG project said in an investor conference call

Tuesday, Oct. 4, 2011.

India could also be big customer for

LNG shipped from the Horn River in northeastern BC through Kitimat,

Encana said.

Although Japan will be increasing its

purchases of liquified natural gas in the coming years, the immediate

situation with Japan is less certain. While the March 2011

earthquake and tsunami knocked out the Fukishima nuclear plant and

prompted Japan to scale back other nuclear plants and increase LNG

purchases, Encana says the country has still not come up with any

definite policies

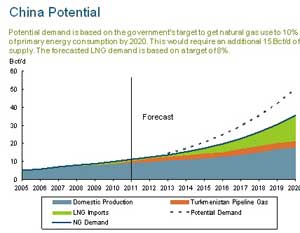

Dave Thorn, Encana vice president of

Dave Thorn, Encana vice president of

Canadian marketing, who also oversees the Encana’s role in the

Kitimat project, said that China’s overseas imports now account for

eight per cent of its purchases of natural gas. That is expected to

rise to 10 per cent in the next few years. Thorn said there is a big

gap between current LNG contracts and what Encana says is long term

demand from China. He speculated that there could be increasing

demand from China during the 20 years or so the Kitimat LNG project

is exporting LNG. ( As well as projected population and

manufacturing growth, even in a weak economy, China is now heavily

dependent on coal, but is also investing in “green” projects

which means there could eventually be a switch from coal to natural

gas).

The fact that one giant Chinese

customer, PetroChina, pulled out of a deal with Encana earlier this

year doesn’t seem to be a setback. Thorn said that there is strong

interest from at least six unnamed major customers for LNG to be

shipped through Kitimat. “The expression of interest ranged from

simply LNG supply to existing or planned regasification facilities

through to participation all along the value chain from shipping,

equity interest in the Kitimat facility as well as upstream

participation,” Thorn said.

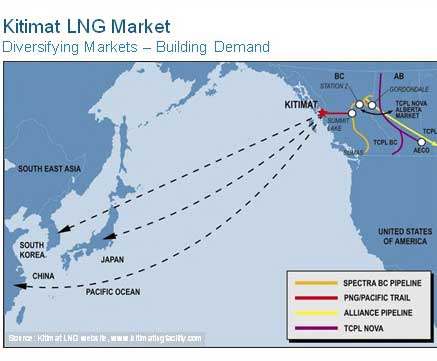

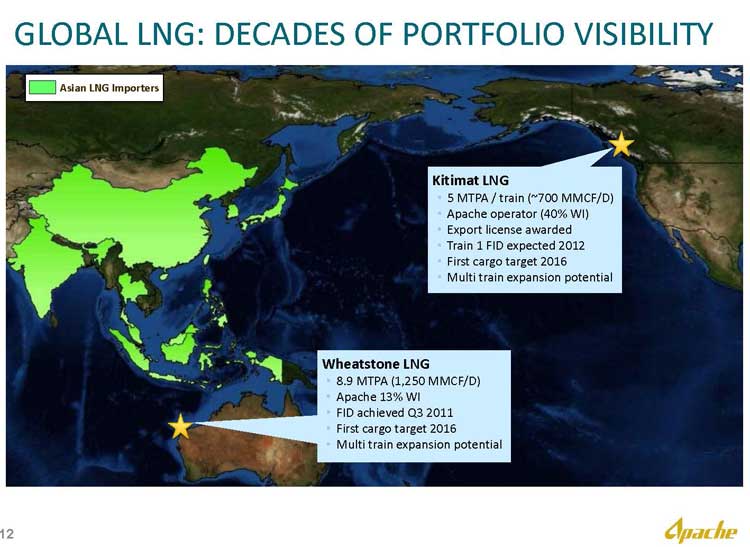

The Kitimat project is currently

The Kitimat project is currently

undergoing a front end engineering evaluation by KBR. There is a

similar study under way on the Pacific Trails Pipeline that could

carry the natural gas to the terminal. Both studies are expected to

be complete by the end of 2011. Encana expects the National Energy

Board to approve KM LNG’s application for an export licence in

December. Encana and its partners, Apache Corporation and EOG

Resources, expect to make a final investment decision in January

2012.

If all goes as planned the Kitimat

terminal would be shipping 700 million cubic feet of natural gas a

day to Asia when the terminal begins operations in 2015. Encana and

its partners are already optimistic, talking about plans to double

capacity to to 1.5 billion cubic feet a day in the coming years.

What’s driving much of this is the

high price of natural gas in Asia, which is pegged to the price of

oil, compared to North America where natural gas prices are

determined by the marketplace. With shale gas increasingly abundant

the price on this continent has been dropping and that has affected

the bottom lines and stock prices of Encana and other natural gas

producers. Encana is also bolstering its bottom line by tapping

“liquid-rich reserves” (oil and natural gas) that may be found

in the areas where they are currently pumping natural gas.

The Horn River Basin area in

northeastern BC was a surprise discovery by an Encana crew in 2003,

said Kevin Smith, Encana Vice President of New Ventures. The company

then began to quietly acquire assets, either by buying land or by

leasing in the region. “The Horn River resource base is enormous,

highly accessible and will certainly play a large role in North

American and even global gas supply in the years to come,” Smith

told the conference call.

During the June NEB hearings in

Kitimat, witnesses described the Horn River formation as special but

were reluctant to go into detail. Smith said the shale in the Horn River

is “all the attributes for high productivity,” including large

reserves and “overpressured system” which helps extraction. “It

keeps getting better and better.”

As well as going west to Asia, natural

gas from Encana’s Horn River assets will go east to Alberta to fuel

bitumen sands production which Smith said will require an additional

1.3 billion cubic feet a day by 2020, This is likely to be

controversial with the environmental groups and bitumen sands

opponents who have always taken issue with the idea that clean

natural gas would be burned to help get crude of the dirtier bitumen

sands.

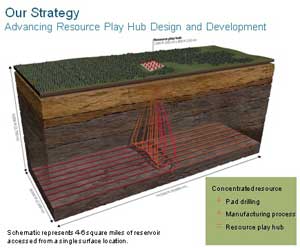

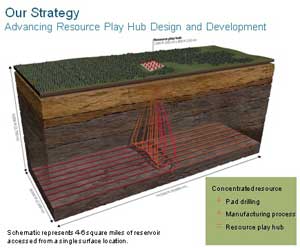

Encana says it has developed a “hub”

Encana says it has developed a “hub”

system in the Horn River where a central well site can use horizontal

drilling to tap areas where once many wells would have been needed.

“Fracking” or fracturing shale gas

requires large amounts of water. As was pointed out in the June

hearings in Kitimat, Encana has tapped an ancient, underground alt

water reservoir called Debolt which allows it to reuse the water from

the formation and minimizing use of local fresh water.

British Columbia is helping the shale

gas industry with favourable royalties in the northeast including

royalty credits for building infrastructure in the region.

Encana, however, is under pressure

from inflation. It faces rising costs from steel, labour and all

kinds of services. While it supplies the bitumen sands with natural

gas, it is also in competition with the Fort MacMurray area for

supplies and labour.

Related links

Dow Jones (via Fox) Encana Eyes Asia As Key Market For B.C. Natural Gas

CP (via Canadian Business) Encana says costs of labour, steel, services rising in energy sector

China is probably the largest long

China is probably the largest long Dave Thorn, Encana vice president of

Dave Thorn, Encana vice president of The Kitimat project is currently

The Kitimat project is currently Encana says it has developed a “hub”

Encana says it has developed a “hub”