The federal Environment Assessment Agency is asking northwestern British Columbia to comment on whether or not a federal assessment is needed for the TransCanada Coastal GasLink pipeline project that would feed natural gas to the proposed Shell facility in Kitimat.

In a news release from Ottawa, the CEAA said:

As part of the strengthened and modernized Canadian Environmental Assessment Act, 2012 (CEAA 2012) put in place to support the government’s responsible resource development initiative, the Canadian Environmental Assessment Agency must determine whether a federal environmental assessment is required pursuant to the CEAA 2012 for the proposed Coastal GasLink Pipeline Project in British Columbia (B.C.). To assist it in making its decision, the Agency is seeking comments from the public on the project and its potential effects on the environment.

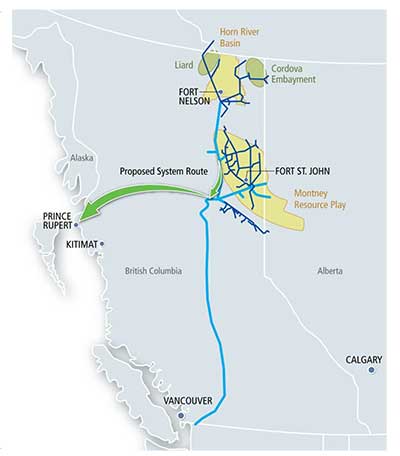

Coastal GasLink Pipeline Ltd. is proposing the construction and operation of an approximately 650-km pipeline to deliver natural gas from the area near the community of Groundbirch, B.C. (40 km west of Dawson Creek) to a proposed liquefied natural gas facility near Kitimat, B.C. The project will initially have the capacity to flow approximately 1.7 billion cubic feet of natural gas per day and could deliver up to approximately 5.0 billion cubic feet per day of natural gas after further expansion.

Written comments must be submitted by December 3, 2012.

Like the current Enbridge Northern Gateway project Joint Review Panel and the National Energy Board hearings in June 2011 on the Kitimat LNG project all comments received will be considered public.

The CEAA says after it has received the comments whether or not there should be an assessmet, it will post a decision on its website stating whether a federal environmental assessment is required.

The CEAA goes on to say:

If it is determined that a federal environmental assessment is required, the public will have three more opportunities to comment on this project, consistent with the transparency and public engagement elements of CEAA 2012.

Projects subject to CEAA 2012 are assessed using a science-based approach. If the project is permitted to proceed to the next phase, it will continue to be subject to Canada’s strong environmental laws, rigorous enforcement and follow-up, and increased fines.

If there is a federal assessment, the most likely course would be to create a new Joint Review Panel. However, this will not be a JRP with the National Energy Board, because the Coastal GasLink project does not cross a provincial boundary, thus it would not make it subject to scrutiny by the NEB.

Instead, if current practice is followed (and that is uncertain given the evolving role of the Harper government in environmental decisions) the new JRP would be in partnership with the British Columbia Oil and Gas Commission, which has jurisdiction over energy projects that are entirely within the province of BC.

However. Shell will have to apply to the NEB for an export licence for the natural gas as both the KM LNG and BC LNG projects did last year. That could result in parallel hearings, one for the export licence, and a second on the environmental issues, which, of course, is the direct opposite of what the Harper government intended when it said it would speed up the reviews with its “one project, one review” policy.

Confusion at Alberta Jackpine JRP

At present, there is a CAEE-Alberta Energy Resources Conservation Board Joint Review Process underway in northern Alberta for the controversial Shell Canada Jackpine project. Shell has proposed expanding the Jackpine Mine about 70 kilometres north of Fort McMurray on the east side of the Athabasca River. The expansion project would increase bitumen production by 100,000 barrels per day, bringing production at the mine to 300,000 barrels per day.

The Jackpine Joint Review Panel is the first to held under the new rules from Bill C-38 that limit environmental assessment.

The lead up to the Alberta Jackpine Joint Review Panel hearings was mired in confusion, partly because of the restrictions imposed by the Harper government in Bill C-38 which limited the scope of environmental assessments.

The local Athabasca Chipewyan First Nation is opposed to the project and, in October, argued that it should be allowed to issue a legal challenge against Shell’s proposed expansion of the Jackpine project.

According to initial media reports in The Financial Post, the Joint Review Panel excluded First Nations further downstream from the Jackpine project ruling and individual members of the Athabasca Chipewyan First Nation that they were not “interested parties.” The Post cited rules on who can participate were tightened up when the Harper government changed the criterion for environmental assessment under Bill C-38. The Financial Post reported a French-owned oil company was permitted to participate.

On October 26, the Jackpine JRP ruled that it did not have the jurisdiction to consider questions of constitutional law, but told the Athabasca Chipewyan First Nation and the Alberta Metis that it would “consider the evidence and argument relating to the potential effects of the project brought forward by Aboriginal groups and individuals during the course of the hearing.”

A few days after the Financial Post report, Gary Perkins, counsel for the Jackpine Joint Review Panel released a letter to participants including Bill Erasmus, Dene National chief and Assembly of First Nations regional chief, who said he was denied standing. There appears to have been confusion over how people could register as intervenors for the Jackpine hearings, since according to the Perkins letter they apparently did so on a company website that no relation to the Jackpine JRP. Perkins also attempted to clarify its constitutional role with First Nations, saying it did not have jurisdiction to decide whether or not the Crown was consulting properly. (PDF copy below)

The Perkins letter also said that the Fort McKay First Nation, Fort McMurray First Nation #468, the Athabasca Cree First Nation, Fort McKay Metis Community Association and the Metis Association of Alberta Region 1 plus some individual members of First Nations are allowed to participate in the hearings.

Controversy continued as the hearings opened, as reported in Fort McMurray Today, that there was poor consultation between Shell and the local First Nations and Metis communities.

On November 8, ACFN spokesperson Eriel Deranger and Athabasca Chipewyan Chief Allan Adam said the project was a threat to the traditional life of Alberta First Nations: “Our land … have shrunk and continue to shrink because of the development,” Adam told the newspaper.

Hot potato for the District of Kitimat

The arcane rules of the Northern Gateway Joint Review Panel has caused months of confusion and frustration for many of those who participated, whether they from the BC provincial Department of Justice or other government participants, intervenors or those making ten minute comments.

Although most people in northwestern British Columbia support the liquified natural gas projects, the prospect of a new Joint Review Panel could likely quickly become controversial in this region. A Coastal GasLink JRP will be the first real test of the restrictions on environmental review imposed on Canada by the Harper government. Environmental groups, especially the few groups that oppose any pipeline projects, will be wary of precedents and likely to test the limits from Bill C-38. Both environmental groups and First Nations will be on alert for any limitations on who can participate in a review. First Nations, even if they support the LNG projects, as most do, will be wary of any attempt by the federal government to limit consultation, rights and title.

A Coastal Gaslink JRP will be a big hot potato for District of Kitimat Council, which has taken a controversial strictly neutral position on the Enbridge Northern Gateway pipeline project until after that Joint Review Panel reports sometime in 2014. Can the District Council now take a positive position on a natural gas pipeline, which from all appearances council supports, long before a Coastal GasLink JRP report (if there is a panel) without facing charges of hypocrisy?

The northwest is in for interesting times.

Canadian Environmental Assessment Page for Coastal GasLink Project

CEAA Coastal GasLink project description (pdf)

Letter about participation in the Jackpine JRP