The Haisla Nation has confirmed in a filing with the Northern Gateway Joint Review Panel that it opposes the Enbridge Northern Gateway project.

The Haisla Nation has confirmed in a filing with the Northern Gateway Joint Review Panel that it opposes the Enbridge Northern Gateway project.

The document, filed June 29, 2012, is one of the most significant filed with the JRP during all the years of the debate over the controversial Northern Gateway, setting out a three stage process that will govern, whether Enbridge or the federal government like it or not, the future of the Northern Gateway pipeline project.

First, the Haisla Nation affirms that it opposes the Northern Gateway project

Second, the Haisla Nation is demanding that the federal government, in recognition of aboriginal rights and title, reject the Northern Gateway project on Haisla traditional territory.

Third, probably anticipating that Stephen Harper and his government will attempt to force the Northern Gateway on British Columbia, the Haisla are demanding meaningful consultation and set out a stringent set of minimum conditions for the project on Haisla traditional territory.

The Haisla Nation’s lawyers filed the document today late today, June 29, in response to a series of questions posed to the First Nation by Enbridge through the Joint Review process.

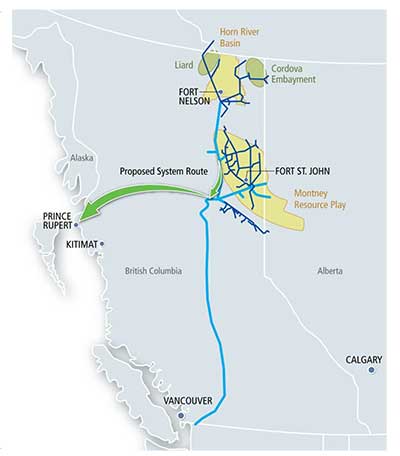

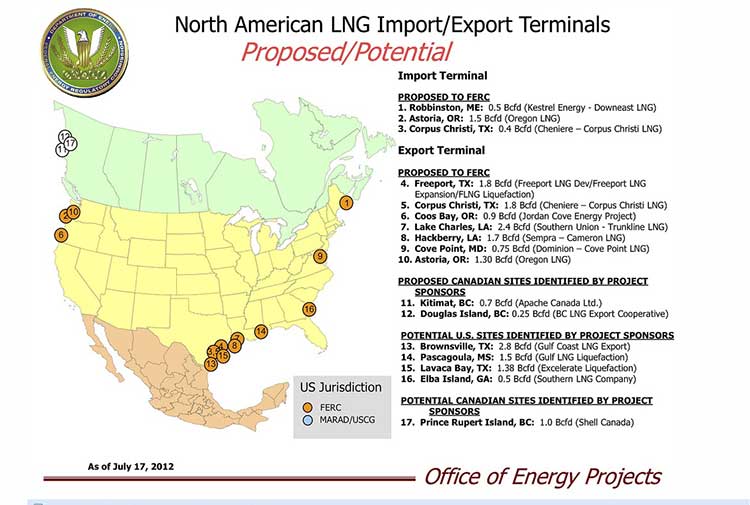

The Haisla also say that there already projects that are better suited to their traditional territory, the liquified natural gas projects.

The Haisla position that Ottawa must reject the pipeline if First Nations oppose it is the opening round in the constitutional battle over not just the pipeline, but entire question of aboriginal rights and title. So far the government of Stephen Harper has said that First Nations do not have a “veto” on the pipeline and terminal project.

The Haisla also refuse to answer questions that Enbridge posed on the liquified natural gas projects because the filing argues, the questions are beyond the scope of the current Joint Review inquiry.

Detailed excerpts

Haisla outline where they believe Enbridge Gateway plans are inadequate

Haisla outline conditions, concerns for Northern Gateway project

Why the Haisla oppose Northern Gateway

In the filing with the Joint Review panel, the Haisla outline nine reasons for opposition to the Northern Gateway project:

1. Northern Gateway is proposing to site its project in a location that places at risk the ecological integrity of a large portion and significant aspects of Haisla Nation Territory and resources.

2. All three aspects of the proposed project – the pipelines, the marine terminal and tankers – have the potential to impact Haisla Nation lands, waters and resources.

3. Northern Gateway has neither conducted sufficient due diligence nor provided sufficient information with respect to the assessment of a number of critical aspects of the proposed project, including but not limited to project design, impacts, risks, accidents and malfunctions, spill response, potential spill consequences and the extent, degree and duration of any significant adverse environmental effects.

4. There are significant risks of spills of diluted bitumen, synthetic crude, and condensate from corrosion, landslide hazards, seismic events along the pipeline route and at the terminal site; as well asloss of cargo or service fuels from tanker accidents, with no realistic plan provided for spill containment, cleanup, habitat restoration or regeneration of species dependent on the affected habitat.

5. Diluted bitumen, synthetic crude and condensate are all highly toxic to the environment and living systems and the consequences and effects of a spill could be devastating on the resources that support the Haisla Nation way of life, and would therefore have significant adverse effects on Haisla Nation culture and cultural heritage and aboriginal rights.

6. Risk assessments and technology have not overcome the potential for human error, wherein it is well established that 80% of oil tanker accidents that cause oil spills at sea are a result of human errors: badly handled manoeuvres, neglected maintenance, insufficient checking of systems, lack of communication between crew members, fatigue, or an inadequate response to a minor incident

causing it to escalate into a major accident often resulting in groundings and collisions (http://www.black-tides.com/uk/source/oil-tanker-accidents/causes-accidents.php). It has also become increasingly obvious that maintenance of pipeline integrity and the remote detection of pipeline ruptures is inadequate as exemplified by major environmental damage from recent pipeline ruptures in Michigan and Alberta.

7. The proposed project requires the alienation of Haisla Nation aboriginal title land, and the federal government has refused to engage in consultation with the Haisla Nation about the potential impacts of the proposed project on Haisla Nation aboriginal rights, including aboriginal title.

8. The proposed project would require the use of Haisla Nation aboriginal title land for a purpose that is inconsistent with Haisla Nation stewardship principles and with the Haisla Nation’s own aspirations for this land.

9. For the reasons set out above, the proposed project would constitute an unjustified infringement of Haisla Nation aboriginal title and rights. It would therefore be illegal for the Crown to authorize the project.

Canada is obliged to decline approval of the project

Up until now, the federal government has refused to engage First Nations in the northwestern region over the issue of the Northern Gateway pipeline and terminal, saying that the constitutionally mandated consultation will take place after the Joint Review Panel has released its report. However, the government’s Bill C-38, which gives the federal cabinet (actually the prime minister) the power to decide the pipeline means that the JRP report will be less significant than it would have been before the Conservatives gained a majority government in May, 2010.

The Haisla say the nation has “repeatedly requested early engagement by federal government decision-makers to develop, together with the Haisla Nation, a meaningful process for consultation and accommodation in relation to the proposed project.”

The filing says JRP and “the federal government’s ‘Aboriginal Consultation Framework’ have been imposed on the Haisla Nation and other First Nations, with significant aspects of the concerns expressed by the Haisla Nation about this approach being ignored.”

The Haisla says it “continues to seek a commitment from the federal government to the joint development of a meaningful process to assess the proposed project and its potential impacts on Haisla Nation aboriginal rights, including aboriginal title.”

Later in the filing the Haisla say:

The Haisla Nation has… repeatedly asked federal decision-makers to commit to the joint development of a meaningful consultation process with the Haisla Nation. The federal Crown decision-makers have made it very clear that they have no intention of meeting with the Haisla Nation until the Joint Review Panel’s review of the proposed project is complete…

The federal Crown has failed to provide any clarity, however, about what procedural aspects of consultation it has delegated to Northern Gateway. Northern Gateway has not consulted with the Haisla Nation and has not advised the Haisla Nation that Canada has delegated any aspects of the consultation process.

The Haisla then go on to say:

Canada is legally required to work with the Haisla Nation to develop and follow such a process. If the process establishes that the approval of the proposed project would constitute an unjustified infringement of Haisla Nation aboriginal rights or aboriginal title, then Canada would be legally obliged to decline approval.

Deficiencies and Conditions

Enbridge asked the Haisla that if there are conditions of approval that would nonetheless

address, in whole or in part, the Nation’s concerns; and then asked for details “on the nature of any conditions that the Haisla Nation would suggest be imposed on the Project, should it be approved.”

The Haisla reply that because there are “significant deficiencies in the evidence provided by Northern Gateway to date.” The nation goes on to say that “the acknowledged risks that have not been adequately addressed in the proposed project.” The Haisla Nation then says it “does not foresee any conditions that could be attached to the project as currently conceived and presented that would eliminate the Haisla Nation’s concerns.”

The Haisla then repeat that Enbridge has not provided sufficient information so that

it is difficult for the Haisla Nation to identify conditions to attach to the proposed project as it is still trying to fully understand the potential impacts of the project and the proposed mitigation. This is primarily because there is insufficient information provided by Northern Gateway in its application material.

Although we have attempted to elicit additional information through the JRP’s information request process, Northern Gateway has not provide adequate and complete answers to the questions posed.

The Haisla then anticipate that Stephen Harper will force the pipeline and terminal on British Columbia and say:

Nevertheless, if the project were to be approved AFTER the Crown meaningfully

consulted and accommodated the Haisla Nation with respect to the impacts of

the proposed project on its aboriginal title and rights, and if that consultation were

meaningful yet did not result in changes to the proposed project, the following

conditions would, at a minimum, have to be attached to the project.

The emphasis of the word “after” is in the original document.

The document that then goes on to present an extensive list of list of conditions the Haisla believe should be imposed on the Enbridge Northern Gateway if the project goes ahead.

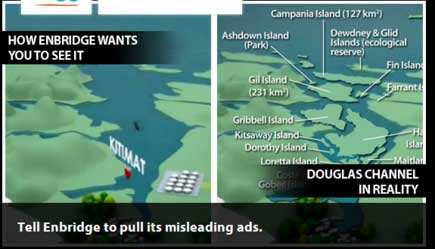

The conditions include comprehensive monitoring of water quality, fisheries, wildlife and birds, vegetation throughout the Kitimat River watershed, Kitimat Arm and Douglas Channel; development of comprehensive spill response capability throughout the Kitimat River Valley, Kitmat Arm and Douglas Channel.

The Haisla also want soil and erosion control plans; water management plans; control and storage plans for fuels, lubricants and other potential contaminants; detailed plans for equipment deployment and habitat reclamation of disturbed or cleared areas.

The Haisla also want much more detailed studies before any construction, including analysis of terrain stability and slide potential throughout the pipeline corridor and at the storage tank and terminal site; engineering designs to mitigate seismic risk and local weather extremes; development of pipeline integrity specifications and procedures including best practices for leak detection; storage tank integrity specifications, maintenance and monitoring; assessment of spill containment, spill response and spill capacity requirements throughout the Kitimat River watershed, Kitimat Arm and Douglas Channel.

On tankers the Haisla want more details beyond the plans already filed by Enbridge including

detailed tanker specifications, detailed tanker and tug traffic management procedures; detailed port management specifications and procedures including operating limits for tanker operation, movement and docking.

The Haisla are also demanding “on going consultation” on all issues involved by the National Energy Board prior to any decision on any changes to or sign off on conditions and commitments to any certificate that is issued.

The Haisla want an independent third party be part of a committee to oversee the construction proecess to monitor certificate compliance during construction of the marine terminal and the pipeline.

Once the pipeline and terminal operational, the Haisla want conditions imposed on the project that include ongoing monitoring of the terrain along the pipeline, a system that would automatically shut down the pipeline shutdown whenever a leak detection alarm occurs.

The Hasila want conditions “on the disposal of any contamination that must be removed as

a result of an accident or malfunction resulting in a spill that will minimize additional habitat destruction and maximize the potential for regeneration of habitat and resources damaged by the spill.”

As well as more detailed parameters for the tankers, tugs, and pilotage procedures, the Haisla want approval of any future changes in those procedures.

The Haisla are also concerned about the “alienation” of a large area of their traditional territory by the construction of the Northern Gateway project as well as the “additional infrastructure” required by adequate spill response capability and spill response equipment cache sites.

The Haisla say “all of the land alienations required for the proposed project would profoundly

infringe Haisla Nation aboriginal title which is, in effect, a constitutionally protected ownership right” and goes on to say “proposed project would use Haisla Nation aboriginal title land in a way that is inconsistent with Haisla Nation stewardship of its lands, waters and resources and with the Haisla Nation’s own aspirations for the use of this land.”

The Haisla filing then goes on to say:

Since aboriginal title is a constitutionally protected right to use the aboriginal title land for the purposes the Haisla Nation sees fit, this adverse use would fundamentally infringe the aboriginal title of the Haisla Nation.

The report also expresses concerns about the ongoing socio-economic affects of such a large project.

It concludes by saying:

These issues are important. They go to the very heart of Haisla Nation culture.

They go to the Haisla Nation relationship with the lands, waters, and resources of

its Territory. A major spill from the pipeline at the marine terminal or from a

tanker threatens to sever us from or damage our lifestyle built on harvesting and

gathering seafood and resources throughout our Territory.

Northern Gateway proposes a pipeline across numerous tributaries to the Kitimat

River. A spill into these watercourses is likely to eventually occur. The evidence

before the Panel shows that pipeline leaks or spills occur with depressing

regularity.

One of Enbridge’s own experiences, when it dumped 3,785,400 liters of diluted

bitumen into the Kalamazoo River, shows that the concern of a spill is real and

not hypothetical. A thorough understanding of this incident is critical to the

current environmental assessment since diluted bitumen is what Northern

Gateway proposes to transport. However, nothing was provided in the application

materials to address the scope of impact, the level of effort required for cleanup

and the prolonged effort required to restore the river. An analysis of this incident

would provide a basis for determining what should be in place to maintain

pipeline integrity as well as what should be in place locally to respond to any spill.

The Kalamazoo spill was aggravated by an inability to detect the spill, by an

inability to respond quickly and effectively, and by an inability to predict the fate

of the diluted bitumen in the environment. As a result, the Kalamazoo River has

suffered significant environmental damage. The long-term cumulative

environmental damage from this spill is yet to be determined.

Looking to the future, the Haisla are also asking for a plan for the eventual decommissioning of the project, pointing out that “ Northern Gateway has not provided information on decommissioning that is

detailed enough to allow the Haisla Nation to set out all its concerns about the

potential impacts from decommissioning at this point in time.”

Haisla leaders have already expressed concern about the legacy of the Eurocan paper plant. Now it tells Enbridge

This is not good enough. The Haisla Nation needs to know how Northern Gateway proposes to undertake decommissioning, what the impacts will be, and that there will be financial security in place to ensure this is done properly.

Asserts aboriginal title

The section of the report concludes by saying:

The Haisla Nation asserts aboriginal title to its Territory. Since the essence of

aboriginal title is the right of the aboriginal title holder to use land according to its

own discretion, Haisla Nation aboriginal title entails a constitutionally protected

ability of the Haisla Nation to make decisions concerning land and resource use

within Haisla Nation Territory. Any government decision concerning lands,

waters, and resource use within Haisla Nation Territory that conflicts with a

Haisla lands, waters or resources use decision is only valid to the extent that the

government can justify this infringement of Haisla Nation aboriginal title.

The Supreme Court of Canada has established that infringements of aboriginal

title can only be justified if there has been, in the case of relatively minor

infringements, consultation with the First Nation. Most infringements will require

something much deeper than consultation if the infringement is to be justified.

The Supreme Court has noted that in certain circumstances the consent of the

aboriginal nation may be required. Further, compensation will ordinarily be

required if an infringement of aboriginal title is to be justified [Delgamuukw].

The Haisla then go on to say that the preferred use of the land in question is for the liquified natural gas projects:

The Haisla Nation has a chosen use for the proposed terminal site. This land

was selected in the Haisla Nation’s treaty land offer submitted to British Columbia

and Canada in 2005, as part of the BC Treaty Negotiation process, as lands

earmarked for Haisla Nation economic development.

The Haisla Nation has had discussions with the provincial Crown seeking to

acquire these lands for economic development purposes for a liquefied natural

gas project. The Haisla Nation has had discussions with potential partners about

locating a liquefied natural gas facility on the site that Northern Gateway

proposes to acquire for the marine terminal. The Haisla Nation sees these lands

as appropriate for a liquefied natural gas project as such a project is not nearly

as detrimental to the environment as a diluted bitumen export project.

Northwest Coast Energy News is attempting to contact Enbridge Northern Gateway for comment on the Haisla filing. Response may be delayed by the Canada Day holiday.

Haisla Nation Response to NGP Information Request (pdf)

![]() Golar LNG, which describes itself on its website as “one of the world’s largest independent owners and operators of LNG carriers” said in its interim results report to shareholders on November 28:

Golar LNG, which describes itself on its website as “one of the world’s largest independent owners and operators of LNG carriers” said in its interim results report to shareholders on November 28: