Could the future of northwestern British Columbia’s hoped for natural gas boom depend on the outcome of this weekend’s Australian general election?

While the mainstream media in North America has mostly been following the personal feud between Prime Minister Kevin Rudd and Opposition Leader Tony Abbott or speculating whether or not Wikileaks founder Julian Assange’s party will make a ripple or a splish, a natural gas crisis has rocketed high on to the Australian election agenda.

I’ll be the first to admit that I know very little about Aussie politics, but I couldn’t ignore all the LNG and natural gas Australian election related stories that suddenly started showing up in my alerts.

LNG train “on ice”

This morning came the alert that Chevron has put the development of another train at its giant Gorgon LNG facility “on ice” (as a pun enabled headline writer in the Western Australian put it)

Chevron and its partners in the Gorgon LNG project on Barrow Island are expected to postpone work on detailed design and engineering of a fourth processing line at the mega project until at least next year as they battle to contain the soaring cost of the foundation development.

As reported by WestBusiness at the weekend, Chevron’s latest internal cost review is understood to have placed a final cost on Gorgon’s three-train venture of up to $US59 billion ($65.6 billion), or 13 per cent above the last confirmed budget revision of $US52 billion.

Chevron is refusing to discuss the status of the cost review and is understood to have told its Gorgon team to “value engineer” in the hope of substantially reducing the latest overrun on a project that was originally supposed to cost $US37 billion to complete.

Raw logs all over again

For a resident of northwestern BC, one thought comes to mind from the media reports on the LNG situation in the Australian election, it’s raw logs all over again.

It appears from those media reports that while Australia has huge reserves of shale-based natural gas, the way the country has structured its LNG boom, major industries and consumers are becoming alarmed that domestic natural gas prices for both will soon skyrocket. There are calls for whatever party wins the election to pass legislation that would create “domestic gas reservation” so that Australians won’t see the gas exported while they pay higher prices for what’s left over.

Most of the shale gas reserves are in Western Australia, while the population—and industry– are concentrated far away on the east coast.

That is leading to another controversy, demands that eastern Australia develop its coal gas reserves, which, of course, brings to mind Shell’s decision to forgo development of coal gas deposits in the Sacred Headwaters and the ongoing fight by the Tahltan First Nation to stop Fortune Minerals’ open pit coal mine in the Sacred Headwaters at Klappan.

Then there’s another vexing issue that northwestern BC is facing and soon have to deal with. In the election, some Australian politicians and unions are calling for curbs on the use for temporary (and not so temporary) foreign workers.

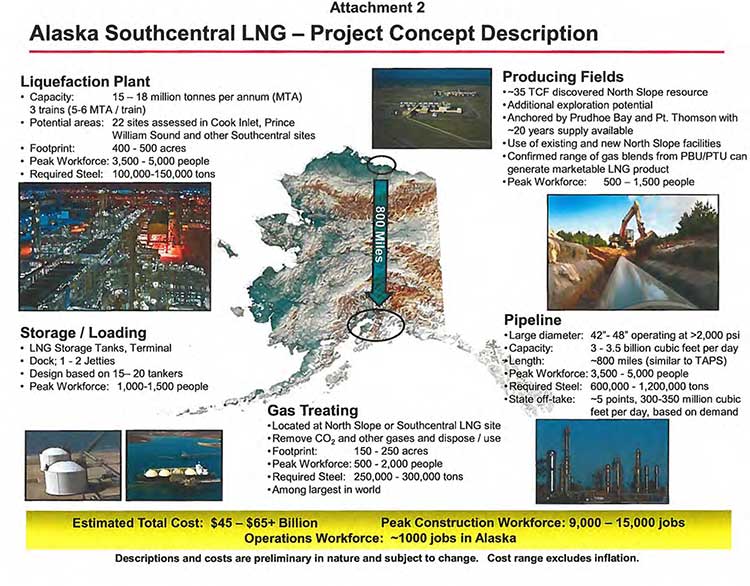

Another factor is the growing cost of natural gas extraction and LNG export, which has, in the midst of the election campaign, pitted Chevron against Australian unions, with Chevron executives (as they did in other contexts before the election call) pointing to Canada—that means Kitimat, folks — as the cheaper alternative.

Rising prices

The Australian has reported that a poll, commissioned by the nation’s manufacturers, so it is somewhat suspect, that:

Manufacturers will today claim that most Australians want a policy of domestic gas reservation and that this would sway voter intentions, a move set to renew the acrimonious debate over rising gas prices.

Manufacturing Australia will release a survey it commissioned where 35 per cent of people said it was “quite likely” and 13 per cent “extremely likely” that it would sway their decision at the election if a party made a policy pledge on the issue.Those uncertain stood at 21 per cent.

In one Australian riding, a local candidate wants one per cent of Australia’s gas be reserved just for the State of Queensland.

Bob Katter flew through Gladstone as fast as the wind whistled through Spinnaker Park on Monday, where he told local media he wanted to reserve a domestic gas supply for Australia and scrap the 457 visas that bring foreign workers into the country….

Mr Katter said mineral processing was under enormous pressure in Australia with copper processing wiped out in northern Queensland and to counter that, the Katter Australia Party would reserve 1% of the gas supply for Queensland.

“Because of the escalating skyrocketing cost of coal, gas and electricity in the past eight years, one per cent of the gas will be reserved for the benefit of the people in Queensland if not Australia,” he said.

“That gas will be used to produce electricity at prices our retirees can afford, and young families can afford, and most importantly that our mineral processing plants have prices for processing they can afford.”

Coal gas

Another story in The Australian quotes James Baulderstone of the Australian energy company Santos:

THE NSW gas industry has warned of higher gas prices, job cuts and a significant risk to the state’s energy security if the coal-seam gas sector is not developed.

James Baulderstone, vice-president of eastern Australia at Santos, said without indigenous gas of its own, NSW had no ability to control its energy supply security.

“NSW faces prospective gas shortages as long-term contracts underpinning the state’s gas supply expire over the next two to three years, the very time in which the commencement of LNG exports from Queensland will see annual gas demand in eastern Australia triple,” he said.

“Looming natural gas shortages in NSW could be avoided by the timely and balanced development of the state’s already discovered reserves of natural gas.”

The Australian Liberal Party (which like BC’s is actually conservative) supports coal gas projects. But it also wants to force energy companies to develop gas reserves they have leased.

Chevron and the unions

Also embroiling the election is the growing dispute between Chevron and the Australian unions.

As the Australian Financial Review reported, Chevron is claiming that high costs are slowing the LNG projects and blaming the government of Prime Minister Kevin Rudd.

The federal government has rejected claims from Chevron that Australia’s high-cost economy is threatening the nation’s biggest energy project, Gorgon, even as the Maritime Union of Australia demands a 26 per cent pay rise and more than 100 other benefits for its members, including Qantas Club memberships and iTunes store credits.

As Chevron’s $52 billion Gorgon project became embroiled in the election campaign, trade union officials accused Chevron of seeking to dodge responsibility for poor labour productivity and high costs.

The union’s demands for employees working for 19 offshore oil and gas contractors around Australia include a 26 per cent raise over four years, no foreign labour without consultation, union control of hiring and four weeks holiday for every four weeks work.

(Note there are accusations of biased reporting during this election, especially from the media owned by Rupert Murdoch. I could find no independent confirmation of union demands for airline memberships and iTunes credits)

The Australian Labour minister, Gary Gray, who is from Western Australia, and according to reports, in a tough re-election fight, is blaming Chevron and the other energy companies for “failing to control the costs of their staff and contractors.”

“We do need our companies to get better in managing their productivity issues,” he said.

Prime Minister Kevin Rudd said he had studied China’s latest five-year economic plan and concluded Australia’s industrial relations system wasn’t hurting the industry.

Boom or bust?

The Australian Financial Review quotes Chevron Australia managing director Roy Krzywosinski as saying Australia has a two-year window to get policy settings right and fix industrial relations and productivity or risk losing out on billions of further investment in liquefied natural gas projects.

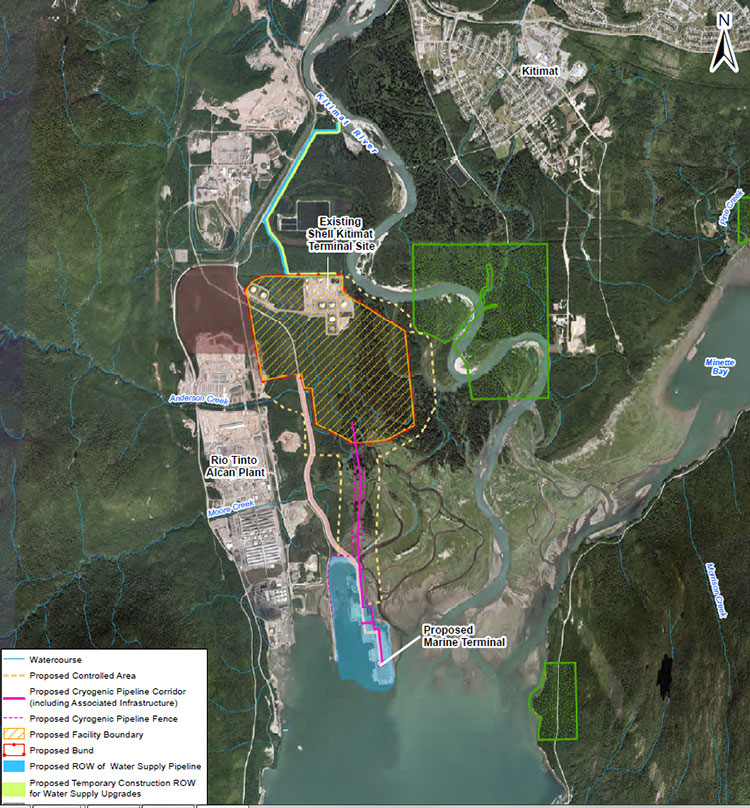

It goes on to make a reference to Shell and operations in Canada—again that’s Kitimat folks.

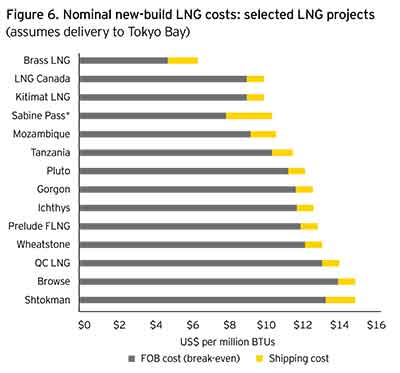

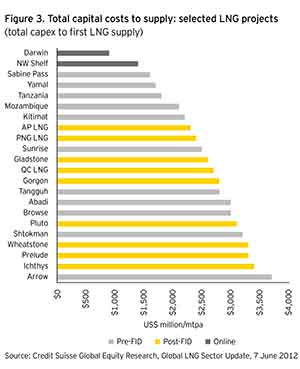

after the unprecedented rush of LNG investment in the past four years, Australia has become the most costly place worldwide for new plants, while new competition is emerging in North America and east Africa.

Shell, which has slowed its $20 billion-plus Arrow LNG project in Queensland, said construction costs in Australia are now up to 30 per cent higher than in the US and Canada.

Mr Krzywosinski said LNG projects are “long-term projects that transcend governments” and Chevron would work with all sides of politics to get policy settings right.

This Australian blogger warns:

The investment surge in LNG – often favourably compared with the Apollo moon program in its magnitude – is in some ways a bubble. Firms have rushed in, extrapolated an endless supply/demand imbalance for their product, ignored global competition, over-paid for assets and developed with little thought to what others were doing, grossly inflating input costs in the process.

The blogger goes on to say

This fallout is typical of the “built it and they will come” attitude that seized energy and mining executives in the final stages of the “commodity super cycle” boom. A similar story, with different dynamics, is playing out in coal and next year in iron ore.

The unions are largely not to blame for the cost blowouts even if they are a party to them. They are, after all, unions. What does capital think will happen if it hands them such a card to play?

Sound familiar?

Australia a mirror of the BC election?

Again it appears from this far off shore, that the Australian election is somewhat mirroring the recent BC provincial election and not only because of the issue of LNG. The Labour PM Kevin Rudd returned to power after three years on the back benches, coming back after the party dumped PM Julia Gillard.

Like BC, the Australian Liberal Party is really conservative. The Liberal Leader Tony Abbott, wants to abolish Australia’s carbon tax but Abbott is also threatening to fine companies that don’t lower prices if (or when) the carbon tax is abolished.

The polls show that the Liberal Party is leading, but that Kevin Rudd is more popular than Tony Abbott. Rudd is running an attack campaign against Abbott, warning of the consequences of an (conservative) Liberal victory. Sounds a bit like Christy Clark.

Given the split in the polls, with the leader of one party more popular than the leader of the party that is leading the polls, this video of the editors of The Australian which accompanies this story shows their senior editors are awfully confident, perhaps over confident, about the polls. I know given what happened in BC, Alberta and even Israel, I’d be a lot more skeptical.

We’ll know the outcome of the Australian election by this time next week. As for LNG, given the volatility of the market, who knows?

(Editor’s Note: Tony Abbott and the Australian Liberal Party won a landslide victory in the weekend vote)

(Note some of the Australian media sites appear to be metered and allow only one viewing)